Safe Banking for Seniors (SBFS) is a free national program, sponsored by the ABA Foundation, that provides bankers with the tools and resources necessary to help older adults, their families and caregivers prevent elder financial abuse and exploitation. The program consist of four turn-key modules with presentations, activity sheets, resource sheets, and guides to help bankers connect with their local communities to share about: identifying and avoiding scams; preventing identity theft; choosing a financial caregiver; and acting as a responsible financial caregiver.

Below are links to helpful teaching tools provide by the ABA Foundation.

Do you know how to spot an imposter scam? Imposter scams often begin with a call, text message, or email. Use the American Bankers Association Foundation and Federal Trade Commission’s’ joint infographic to educate yourself.

Do you know how to spot an imposter scam? Imposter scams often begin with a call, text message, or email. Use the American Bankers Association Foundation and Federal Trade Commission’s’ joint infographic to educate yourself.

According to the FTC, Americans lost more than $667 million to imposter scams in 2019. Imposter scams take many forms, including call, email or text message.

According to the FTC, Americans lost more than $667 million to imposter scams in 2019. Imposter scams take many forms, including call, email or text message.

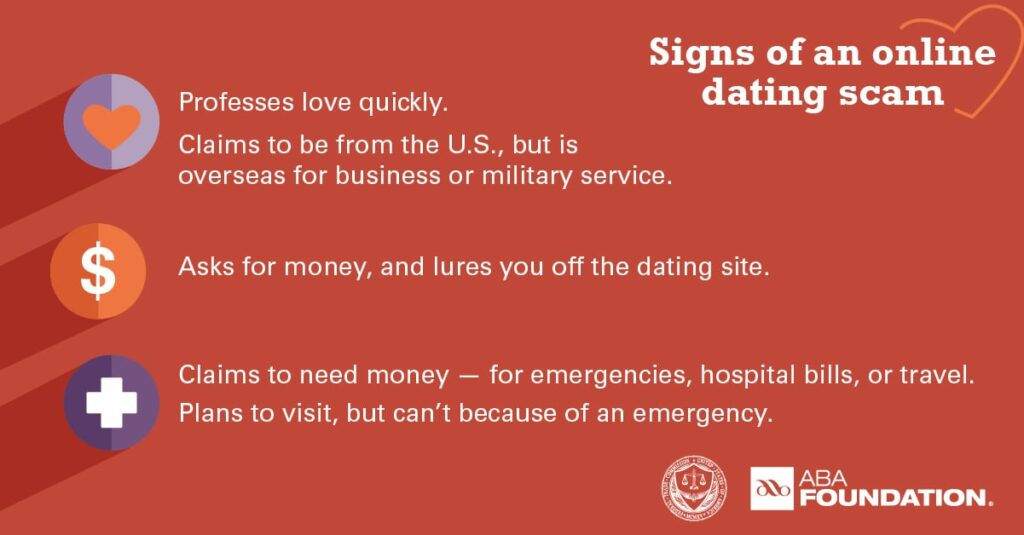

Do you know the signs of an online dating scam? Red flags of romance scams include people who:

Do you know the signs of an online dating scam? Red flags of romance scams include people who:

- Profess love quickly

- Lure you off the dating site

- Need money for emergencies

Older adults lose billions of dollars each year to fraud. Financial abuse against older Americans can take many forms, from illegal debits, to third-party scams and even unauthorized withdrawals by an approved caregiver. Learn how to prevent elder financial abuse through these free resources from the American Bankers Association Foundation: https://bit.ly/2PLvA5r

Older adults lose billions of dollars each year to fraud. Financial abuse against older Americans can take many forms, from illegal debits, to third-party scams and even unauthorized withdrawals by an approved caregiver. Learn how to prevent elder financial abuse through these free resources from the American Bankers Association Foundation: https://bit.ly/2PLvA5r

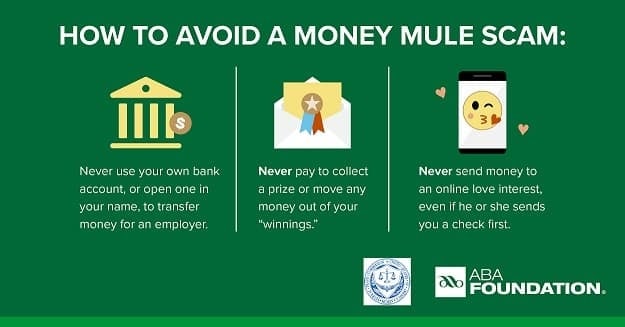

If someone sends you money and asks you to send it to someone else, stop! You could be what some call a money mule.

If someone sends you money and asks you to send it to someone else, stop! You could be what some call a money mule.

Do you know what to do if you spot a money mule scam? Follow these steps:

Do you know what to do if you spot a money mule scam? Follow these steps:

- Break off contact with scammer

- Tell your bank

- Report it to the FTC

Fake checks continue to be one of the most common instruments used to commit fraud against consumers.

Fake checks continue to be one of the most common instruments used to commit fraud against consumers.

Granting a power of attorney is a major commitment. Learn tips on how to choose the best power of attorney for your situation from the American Bankers Association Foundation’s Safe Banking for Seniors program: https://bit.ly/32PCPPO

Granting a power of attorney is a major commitment. Learn tips on how to choose the best power of attorney for your situation from the American Bankers Association Foundation’s Safe Banking for Seniors program: https://bit.ly/32PCPPO