ABA Foundation’s national campaign to provide teens and young adults with well-rounded personal finance skills through local banks is now more immersive and flexible than ever. This industry-wide movement to expand the reach of financial education gives bankers free tools to equip young people with identity theft prevention skills, the chance to explore banking careers and more—both in and out of the classroom.

Below are links to helpful teaching tools provide by the ABA Foundation.

Developing a habit of saving early on is a great way to ensure you are prepared in case of a financial emergency. Use these tips from the American Bankers Association Foundation to help:

Developing a habit of saving early on is a great way to ensure you are prepared in case of a financial emergency. Use these tips from the American Bankers Association Foundation to help:

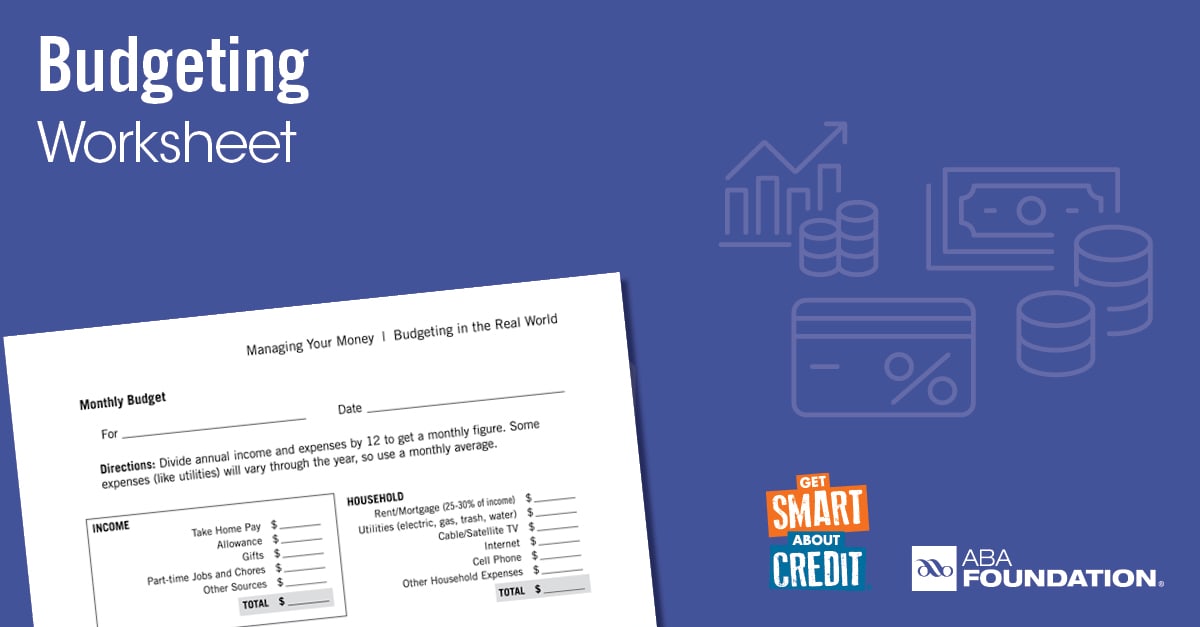

Budgeting is an important part of making sound financial decisions. Need help making a monthly budget? Use this worksheet from the American Bankers Association Foundation’s Get Smart About Credit program: https://aba.social/46no9WT

Budgeting is an important part of making sound financial decisions. Need help making a monthly budget? Use this worksheet from the American Bankers Association Foundation’s Get Smart About Credit program: https://aba.social/46no9WT

Successful saving is as easy as 1, 2, 3! Start saving early so that you are prepared in case of a financial emergency. Click to watch for helpful tips from the @American Bankers Association Foundation.

Successful saving is as easy as 1, 2, 3! Start saving early so that you are prepared in case of a financial emergency. Click to watch for helpful tips from the @American Bankers Association Foundation.

You probably know your GPA, but did you know your credit score is like your financial GPA? Get Smart About Credit and find out how your credit score is calculated and how you can raise your score:

You probably know your GPA, but did you know your credit score is like your financial GPA? Get Smart About Credit and find out how your credit score is calculated and how you can raise your score:

A credit report is essentially your financial resume – a file on you that can be accessed by potential employers, landlords or insurance companies. How can you establish a good credit history? Get Smart About Credit and find out here: https://aba.social/464OBoB

A credit report is essentially your financial resume – a file on you that can be accessed by potential employers, landlords or insurance companies. How can you establish a good credit history? Get Smart About Credit and find out here: https://aba.social/464OBoB

Accumulating debt can have a negative impact on your credit score. Do you have your debt under control? Get Smart About Credit and learn to manage it responsibly: https://aba.social/3ET7K0D

Accumulating debt can have a negative impact on your credit score. Do you have your debt under control? Get Smart About Credit and learn to manage it responsibly: https://aba.social/3ET7K0D

Why take an L when you could take a W? Watch to discover the 5 Ws of becoming a banker – the who, what, when, where, and why a career in banking could be for you. Click here to view video.

Why take an L when you could take a W? Watch to discover the 5 Ws of becoming a banker – the who, what, when, where, and why a career in banking could be for you. Click here to view video.

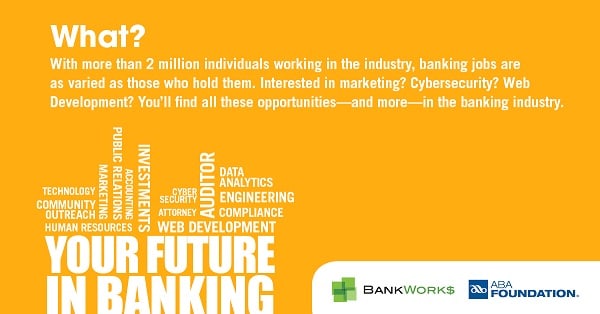

A career in banking can take you far – and isn’t only about numbers! Are you creative? Do you possess leadership savvy? No matter your interest the banking industry is looking for those with a wide variety of skills! Find out more from Bank Works and the American Bankers Association Foundation: https://aba.social/3AhhopN

A career in banking can take you far – and isn’t only about numbers! Are you creative? Do you possess leadership savvy? No matter your interest the banking industry is looking for those with a wide variety of skills! Find out more from Bank Works and the American Bankers Association Foundation: https://aba.social/3AhhopN

What careers can you find in banking? The industry is more than just finance. From cybersecurity to marketing, you can find a position that will lead you to success! Find out more from Bank Works and the American Bankers Association Foundation: https://aba.social/3AhhopN

What careers can you find in banking? The industry is more than just finance. From cybersecurity to marketing, you can find a position that will lead you to success! Find out more from Bank Works and the American Bankers Association Foundation: https://aba.social/3AhhopN

No matter the career path you have in mind, the banking industry can help your professional growth. Find out more from Bank Works and the American Bankers Association Foundation: https://aba.social/3AhhopN

No matter the career path you have in mind, the banking industry can help your professional growth. Find out more from Bank Works and the American Bankers Association Foundation: https://aba.social/3AhhopN

Think it’s too soon for you to start your career in banking? Think again! You can apply for a job in the banking industry right out of high school. Find out more from Bank Works and the American Bankers Association Foundation: https://aba.social/3AhhopN

Think it’s too soon for you to start your career in banking? Think again! You can apply for a job in the banking industry right out of high school. Find out more from Bank Works and the American Bankers Association Foundation: https://aba.social/3AhhopN

Why banking? There are plenty of reasons why a career in the banking industry is a smart choice. Explore them in this info sheet from Bank Works and the American Bankers Association Foundation: https://aba.social/3AhhopN

Why banking? There are plenty of reasons why a career in the banking industry is a smart choice. Explore them in this info sheet from Bank Works and the American Bankers Association Foundation: https://aba.social/3AhhopN

Millions of people are victims of identity fraud each year. As young adults become more financially independent, it’s important for them to understand this form of theft so they don’t fall prey to scammers. Use this info sheet from the American Bankers Association Foundation to help your teen understand identity fraud: https://aba.social/3EeYa6J

Millions of people are victims of identity fraud each year. As young adults become more financially independent, it’s important for them to understand this form of theft so they don’t fall prey to scammers. Use this info sheet from the American Bankers Association Foundation to help your teen understand identity fraud: https://aba.social/3EeYa6J

Don’t become a victim of identity theft! As young people become more financially independent, they are at an increased risk of being targeted by scammers. Use these tips from the American Bankers Association Foundation to learn how to spot and prevent identity theft: https://aba.social/3zaMUof

Don’t become a victim of identity theft! As young people become more financially independent, they are at an increased risk of being targeted by scammers. Use these tips from the American Bankers Association Foundation to learn how to spot and prevent identity theft: https://aba.social/3zaMUof

So you’ve joined the millions of others that are victims of identity fraud each year. What now? Follow these steps from the American Bankers Association Foundation: https://aba.social/3nyyGv6

So you’ve joined the millions of others that are victims of identity fraud each year. What now? Follow these steps from the American Bankers Association Foundation: https://aba.social/3nyyGv6

Don’t become a victim of identity theft! As teens become more financially independent, they are at an increased risk of being targeted by scammers. Use these tips from the American Bankers Association Foundation to learn how to spot and prevent identity theft: https://aba.social/3zaMUof(Opens in a new Window)

Don’t become a victim of identity theft! As teens become more financially independent, they are at an increased risk of being targeted by scammers. Use these tips from the American Bankers Association Foundation to learn how to spot and prevent identity theft: https://aba.social/3zaMUof(Opens in a new Window)

Many factors and decisions go into choosing and paying for college. While requirements and priorities differ from person to person, one thing is constant: the cost of college is considerable, and rising. Use this tip sheet from the American Bankers Association Foundation’s Get Smart About Credit program to help you make informed decisions: https://aba.social/3CaPZ9y

Many factors and decisions go into choosing and paying for college. While requirements and priorities differ from person to person, one thing is constant: the cost of college is considerable, and rising. Use this tip sheet from the American Bankers Association Foundation’s Get Smart About Credit program to help you make informed decisions: https://aba.social/3CaPZ9y

Figuring out how to finance your higher education can be overwhelming. Access a list of useful websites, scholarship opportunities and apps that you can trust: https://aba.social/39bc6Ak

Figuring out how to finance your higher education can be overwhelming. Access a list of useful websites, scholarship opportunities and apps that you can trust: https://aba.social/39bc6Ak

Many factors and decisions go into choosing and paying for college. While requirements and priorities differ from person to person, one thing is constant: the cost of college is considerable, and rising. Use these tips from the American Bankers Association Foundation’s Get Smart About Credit program to help you make informed decisions: Click to view video.

Many factors and decisions go into choosing and paying for college. While requirements and priorities differ from person to person, one thing is constant: the cost of college is considerable, and rising. Use these tips from the American Bankers Association Foundation’s Get Smart About Credit program to help you make informed decisions: Click to view video.

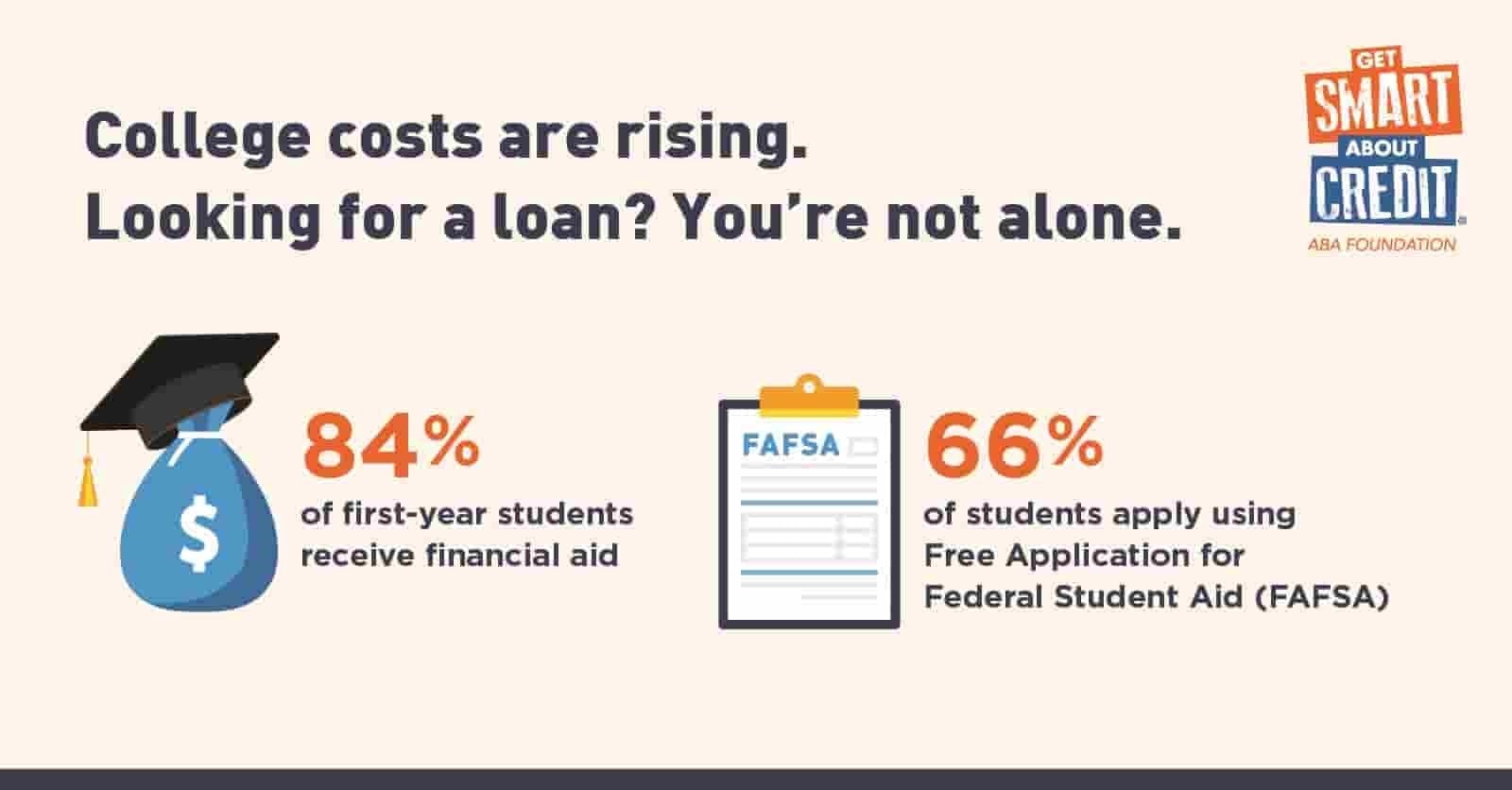

College costs are rising. Looking for a loan? You’re not alone. Be wary of the information you share, and where. Find out more in the @American Bankers Association Foundation’s #GetSmartAboutCredit infographic on scholarship and student loan scams: https://aba.social/3cPurZl

College costs are rising. Looking for a loan? You’re not alone. Be wary of the information you share, and where. Find out more in the @American Bankers Association Foundation’s #GetSmartAboutCredit infographic on scholarship and student loan scams: https://aba.social/3cPurZl

College costs are rising, and you may be planning to take out a student loan. Be wary of the information you share, and where. Find out more in the @American Bankers Association Foundation’s #GetSmartAboutCredit infographic on scholarship and student loan scams: https://aba.social/3cPurZl

College costs are rising, and you may be planning to take out a student loan. Be wary of the information you share, and where. Find out more in the @American Bankers Association Foundation’s #GetSmartAboutCredit infographic on scholarship and student loan scams: https://aba.social/3cPurZl

Consumers across the country are in the process of exploring student loan debt forgiveness opportunities following the Biden administration’s announcement in late August. As they do so, it’s important they remain on high alert for suspicious behaviors that may indicate a criminal scheme. Learn how to spot student loan forgiveness scams in this #GetSmartAboutCredit infographic from the @American Bankers Association Foundation: https://aba.social/3CLkMNl

Consumers across the country are in the process of exploring student loan debt forgiveness opportunities following the Biden administration’s announcement in late August. As they do so, it’s important they remain on high alert for suspicious behaviors that may indicate a criminal scheme. Learn how to spot student loan forgiveness scams in this #GetSmartAboutCredit infographic from the @American Bankers Association Foundation: https://aba.social/3CLkMNl